We run your numbers so you can run your business.

At Black Dog Financial, we turn your financial data into clear insight you can act on, helping you make strategic business decisions. We are your financial department as a service. It all starts with good bookkeeping.

How We Can Help

-

We work with you to deliver reliable financial reports so you can focus on growing your business.

Each month, we deliver a Monthly Client Report—a complete financial package that includes your Profit & Loss, Balance Sheet, and Cash Flow Statement. It’s designed to make it easy to review results, track monthly trends, and understand the story behind the numbers. This is our deliverable to you that translates bookkeeping data into business intelligence.

We also support various levels of AR/AP Management and Payroll Management.

-

Clarity creates confidence. A financial dashboard will allow you to see trends and proactively make decisions by taking your financial data and presenting it in a consistent consumable report.

Numbers alone don’t tell the story. Our financial dashboard organizes your financials into a clear, visual format that highlights the metrics that affect your decision-making. It’s the tool that helps you move from “working in the business” to “working on the business”.

It’s financial clarity, customized to the goals you want the company to achieve.

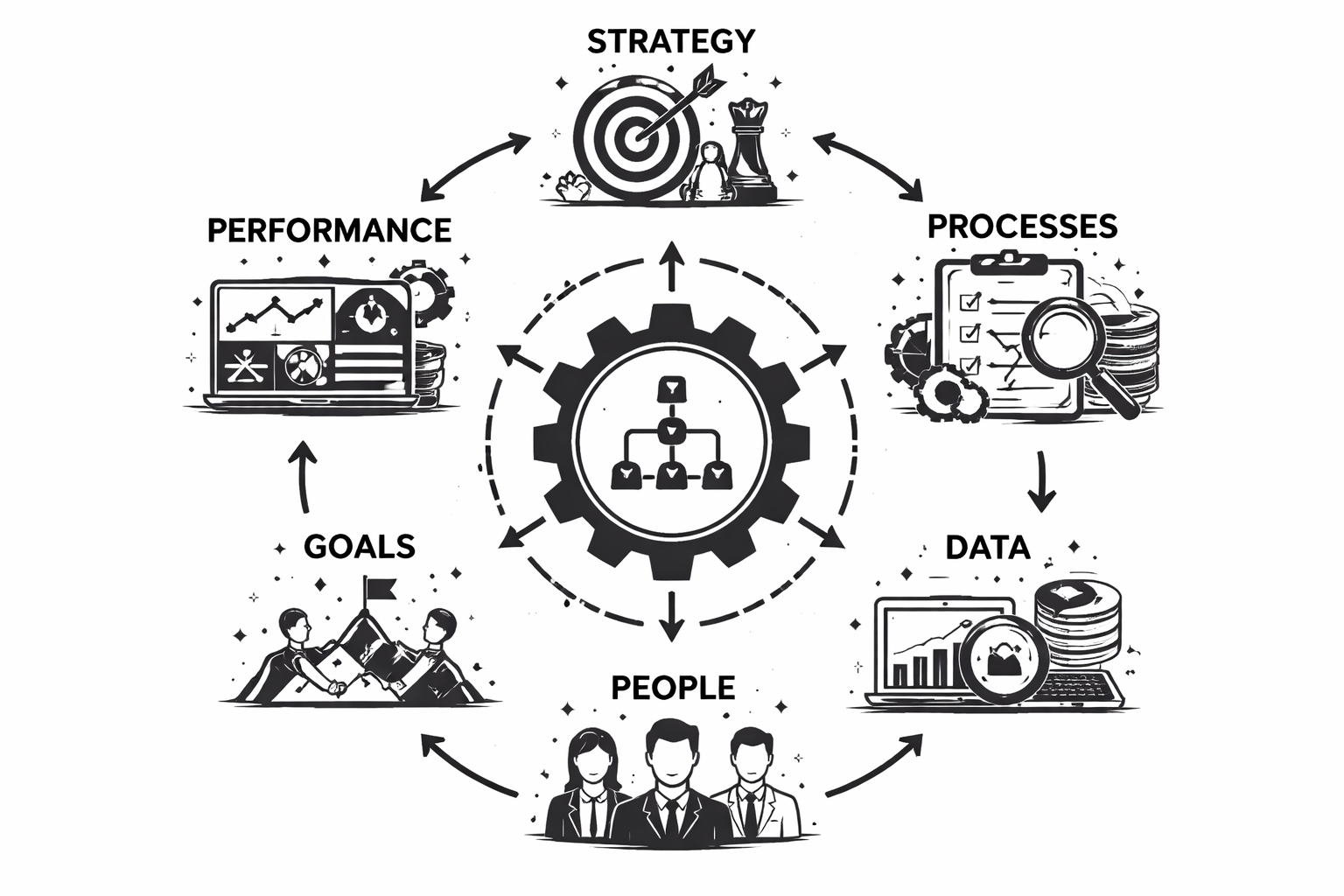

The Foundation

The Finance Strategy

-

Every business reaches a point where instinct alone isn’t enough. A CFO helps you move from intuition to intention — stabilizing the company, guiding strategic growth, and managing risk with clarity.

Through structured monthly meetings, you gain the insight, discipline, and foresight of a seasoned financial leader at a fraction of the cost of a full-time hire.

Our CFO Strategy Service prioritizes cash flow stability through a 13-week direct cash flow model and a rolling 12-month budget that keeps the business aligned, forward-looking, and prepared for growth.

From there, we help you tackle the strategic initiatives and process improvements you’ve wanted to pursue — the projects that move the company forward but haven’t had a clear path or owner until now.

-

Are you preparing to acquire another company or considering selling equity for growth or an exit? Selling or acquiring a business requires more than interest—it requires preparation. Our M&A Readiness service positions your company for a successful transaction by ensuring your financials are clean, reliable, and investor-ready.

There are two major drivers of value: scalability and profitability. To truly understand these, we evaluate leadership, revenue diversity, financial quality, economic factors, and risk management.

We evaluate your company through an M&A Readiness Scorecard, identifying what drives or limits enterprise value. Then we work with your leadership team to strengthen operations, margins, and financial systems — preparing your business to command a higher multiple before it’s time to sell.

-

Are you still running parts of your business on outdated processes?

Do tasks take longer than they should, or depend on one key person to get done right?

We help you streamline how your business operates — documenting, refining, and systemizing the critical workflows that drive performance. Through structured SOPs, accountability mapping, and operational reviews, we make your business more efficient, scalable, and transferable. The result is a company that runs smoother today and commands a higher valuation tomorrow.

The Operating Strategy

Book a Free Introduction Meeting

Zak Sultan